how to calculate a stock's price

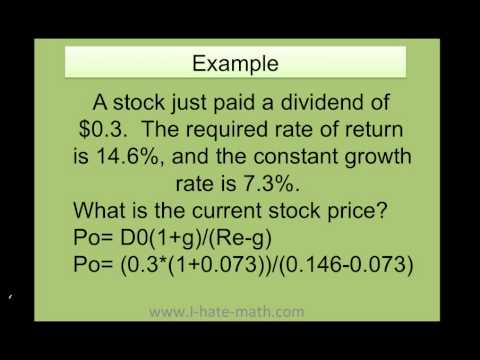

Calculating expected price only works for certain types of stocks. We can rearrange the equation to give us a companys stock price giving us this formula to work with.

Price of Stock A is currently 10000 per share or P0.

. Sort the data in the requisite format. Suppose you bought Reliance stocks at some price expecting that it will move upwards. The formula for calculating the book value per share of common stock is.

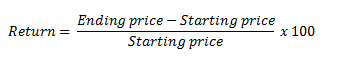

Calculate stock returns manually by using the shift method to stack the stock price data so that and share the same index or. Enter an amount rounded to the nearest dollar. Price Estimated EPS Trailing PE where Price is the variable we are solving for.

Since the industry PE ratio is 10 this may be telling you that the stock is no longer undervalued and its time to sell. For NASDAQ download the dataset from Yahoo Finance. Single Head of household Married filing jointly Married filing separately.

Why Stock Average Calculator. For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices book value for the firm would be 63. 2021 Capital Gains Tax Calculator.

The Stock Calculator uses the following basic formula. To calculate the price of a stock from its dividend yield you also need to know how much it pays in dividends each year. Finding the growth factor A 1 SGR001 Computing the future dividend value B DPS A Calculating the Estimated stock purchase price that would be acceptable C B.

Dividends are expected to be 300 per share Div. Stock price price-to-earnings ratio earnings per share. Announces a 21 stock split.

Calculating Todays Stock Prices. Price Target Current Market Price Current PE Forward PE. Calculating expected price only works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends future stock price is anyones guess.

The buying price of stock typically varies every day due to the market. By using the pct_change. Here look for the trailing PE as of December 31st 2019.

This will give you a price of 667 rounded to the nearest penny. If you buy the stock at 3 the PE ratio is 3 which is calculated by dividing the price of the stock by its earnings per share or 3 divided by 1. Profit P SP NS - SC - BP NS BC Where.

P current stock price. See how the gains you make when selling stocks will be impacted by federal capital gains taxes. For newly established companies with rapid growth and unpredictable earnings and dividends future stock price is anyones guess.

Therefore our capital gain is. Stock bought at different periods in time will cost various amounts of capital. Calculating stock returns on Python is actually incredibly straightforward.

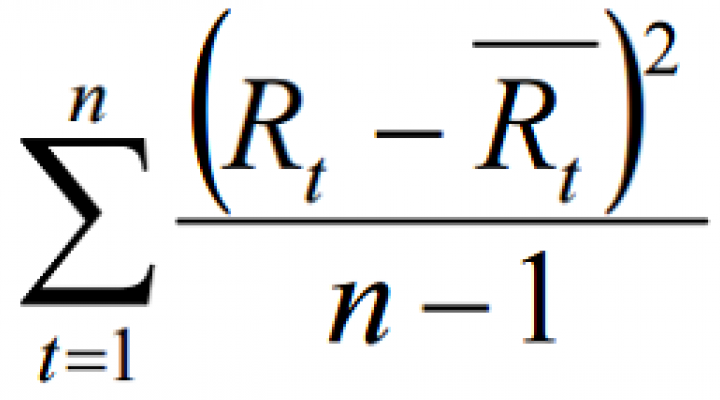

Stock Average Calculator helps you to calculate the average share price you paid for a stock. Therefore first you need to add up all of the dividends the company paid during the prior year. Steps to Calculate Stock Beta are as follows.

Calculate the firms stock price book value from the balance sheet. P D 1 r g where. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of.

Download the stock prices and NASDAQ index prices for the past couple of years. R constant cost of equity capital for said company this is also referred to as the rate of return D 1 value of the following years dividends Using an Example to Understand Share Price Valuation. Likewise download the corresponding stock price data for the MakeMyTrip example from here.

Price 817 3289 where Price is equal to 26871. For example Facebooks target price for 2020 is. The price of Stock A is expected to be 10500 per share in one years time P1.

Second divide the annual dividends by the dividend yield to find the stock price. The algorithm behind this stock price calculator applies the formulas explained here. The formula to calculate the target price is.

For example if there are 10000 outstanding common shares of a company and each share has a par value of 10 then the value of outstanding share amounts to 100000. Enter your purchase price for each buy to get your average stock price. Stock value Dividend per share Required Rate of Return Dividend Growth Rate Rate of Return Dividend Payment Stock Price Dividend Growth Rate.

If the stock price goes up to 10 the new PE ratio is 10. Divide the firms total common stockholders equity by the average number of common shares outstanding. Book value per share Stockholders equity Total number of outstanding common stock.

NS is the number of shares SP is the selling price per share BP is the buying price per share SC is the selling commission BC is the buying commission. In this case the adjusted closing price calculation will be 20 1 21. To compute the average price divide the total purchase amount by the number of shares purchased to.

For an investor price target reflects the price at which he will be willing to buy or sell the stock at a particular period of time or mark an exit from their current position. G constant growth rate in perpetuity anticipated for the dividends of the stock. These are easy formulas once getting the terminology down.

How To Calculate The Historical Variance Of Stock Returns Nasdaq

How To Calculate Return On Indices In A Stock Market The Motley Fool

How To Calculate The Issue Price Per Share Of Stock The Motley Fool

What Is The Enterprise Value Of A Company Enterprise Value Enterprise Company

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

How To Calculate The Historical Variance Of Stock Returns Nasdaq

How To Calculate A Monthly Return On Investment The Motley Fool

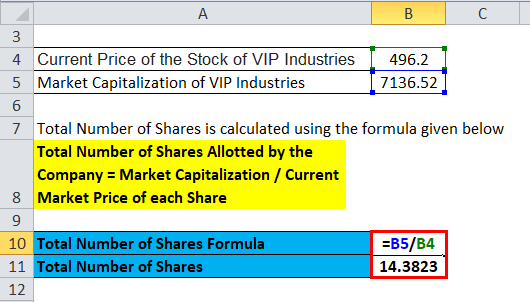

Market Capitalization Formula Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

How To Calculate Weighted Average Price Per Share Fox Business

Avoid Bad Stock Investments Set Realistic Goals With Safer Stocks Investing Investing In Stocks Finance Investing

How To Find The Current Stock Price Youtube

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate The Weights Of Stocks The Motley Fool

This Free Online Stock Investment Calculator Will Calculate The Expected Rate Of Return Given A Stock S Current Dividend Investing Online Stock Online Mortgage

How To Calculate Future Expected Stock Price The Motley Fool

A Bulletproof Answer To A Popular Job Interview Question Https Www Youtube Com Watch V Fcjcdpwqsoo Interview Questions Job Interview Questions Job Interview

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)